Is the biosimilar market a success? Almost ten years since the first U.S. biosimilar launch, Apteka released a paper looking at the current biosimilar landscape, questions whether it has met its objectives and proposes policy solutions for securing the future biosimilars.

Although biosimilar take-up has been gradual, with each biosimilar approved – particularly provider-administered drugs – the market has adapted, and the biosimilar market share has grown more quickly. Across all biologics, the downward pressure on reference biologic prices accounted for nearly two-thirds of estimated savings ($24.6 billion); the remainder resulted from lower biosimilar prices relative to their reference biologics.

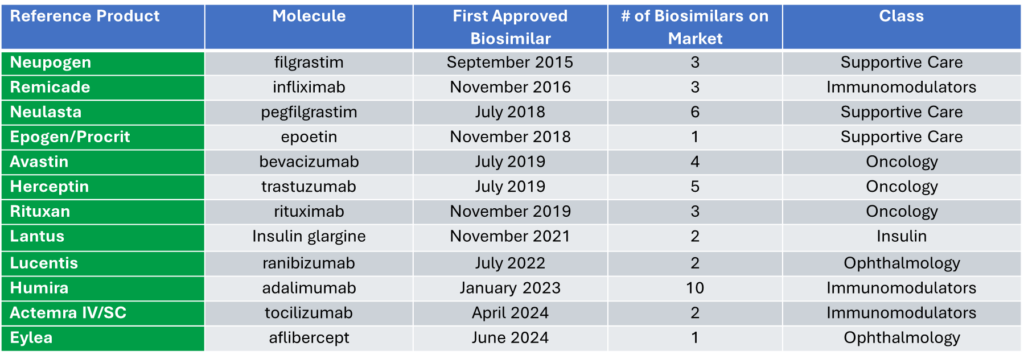

Currently there are 61 approvals with 42 biosimilars launched in the U.S.

After a biosimilar is approved and enters the market, it can face an uphill battle to gain utilization and market share. Uptake depends on physician prescribing which is influenced by their own judgement, understanding of the medicine and payer reimbursement. One found that only 16% of doctors and 13.4% of pharmacists said they felt “very prepared” to talk with patients about biosimilars.

However, the biggest barrier to creating a long-term market for biosimilars will be reimbursement. Rebates motivate payers’ coverage decisions. It is challenging for biosimilars to enter the market and quickly gain enough momentum to gain the scale necessary to be able to compete with established reference products that may be willing to dramatically increase rebates to be competitive with biosimilars.

There are policy solutions that should be considered:

TACKLE MISPERCEPTIONS ABOUT BIOSIMILARS

- Biosimilars are highly similar to their originator reference product, however, if the FDA were to remove the need for switching studies, it could help buoy the overall biosimilar market and increase access by allowing biosimilars to be used more broadly and ease the misperception that non-interchangeable products are not as safe as interchangeable products.

- While the FDA does have resources on biosimilars for providers, physicians and pharmacists need more biosimilar education.

- Specific payment codes could be used to pay to spend time educating patients on biosimilars.

INCENTIVIZE USE OF BIOSIMILARS

- While the add-on fee of 8% of the reference product’s Average Sales Price (ASP) is helpful, it may not be enough to incentivize provider use of biosimilars because it uses average provider acquisition rates which may not reflect an individual provider’s reality.

- The federal government, through Medicare and/or Medicaid, could incentivize providers through quality measures, to use biosimilars or, more boldly, institute reference pricing.

- Continue to review 340B utilization of reference products over biosimilars and consider Medicare changes to reimbursement that would incentivize use of biosimilars.

- Payers and providers could work toward a shared savings arrangement that compensates hospital outpatient departments for additional utilization of biosimilars.

- The Centers for Medicare & Medicaid Services (CMS) could directly call out and financially encourage the use of biosimilars through direct provider administration or through prescriptions in their Center for Medicare and Medicaid Innovation models like the Enhancing Oncology Model or the Accountable Care Model.

- This report was commissioned by the Alliance for Patient Access (AfPA) and the Biologics Prescribers Collaborative.